Hello,

First, I hope you all are doing well. For many of us appraisers, the past 16 months have been very challenging, and there isn’t a light at the end of the tunnel yet. I talk with a lot of appraisers, and while a small (and fortunate) percentage are still busy, that is not the majority.

For those that are panicking, I want to pass on a few things I try to tell myself to stay motivated.

|

The sun will come up tomorrow no matter what I do. |

|

|

My boss (me) requires a minimum of 40 hours a week. |

|

Learn something new. While the old saying is, “The strong survive” that isn’t really true (seen a T-Rex lately?) Figure out what else you can do and work towards that goal. Not everyone will adapt. If you are still doing the same things that you were doing a decade or two ago, rethink your process. |

|

|

Gunga, Galunga. If all else fails, at least I have that going for me. Which is nice. |

Need a chore list? Here are a few things you can work on in your downtime:

SALES

- Sign up with more AMC’s

- Call your local banks and credit unions to see if they order directly or through an AMC.

- Find other clients; asset management firms, hard money lenders, attorneys, etc.

- Who else might benefit from your knowledge? Have you ever thought about doing research on certain market areas and then trying to supply that info to small developers? Could you find good deals on houses for sale and sell that info to flippers?

- Start talking to realtors you know (and don’t know!) Maybe they can refer you to the decision makers at the lenders they work with.

MARKETING

- Work on your website

- Add more content to the pages (enhances Google search status)

- Watch some YouTube to learn how to design it better?

- Add a blog and start posting content (great for Google search)

- Design a nice brochure in MS Word and convert it to a PDF so you can send it to potential clients.

- Use Mailchimp.com to start a drip campaign to prospects.

- Design and buy a magnet sign (from VistaPrint.com or similar) to put on your car and advertise while you drive.

OPERATIONS

- Are your reports still relevant to todays lender requirements and latest versions of USPAP, Fannie Mae Selling Guide, FHA 4000.1? Or could they use an overhaul? You’d be surprised at the number of reports I see that still say, “This is a summary appraisal report” or have language about Covid in them. Spend some time cleaning up your reports.

- Do you use templates, or just clone old reports? A template eliminates the problem of having errors in your reports because you forgot to alter something from the prior report. Your template has only the stuff you need to start with, and none of the stuff you don’t.

I have these templates that I merge new reports to:

-

-

- SFR – Purchase

- SFR – Refi

- SFR – FHA (I use for both refi and purchase)

- SFR – New Construction

- SFR – Subject To (for remodels)

- SFR – Income (with 1007/216)

- SFR – Desktop

- Condo – Purchase

- Condo – Refi

- Condo – New Construction

- Condo – Subject To

- Condo – Income

- 2 Unit Condo — New

- 2 Unit Condo – Resale

- 2-4 Unit – Resale

- 2-4 Unit – New

- Market Value – Standard

- Market Value – Retrospective

- Land

- Field Review

- Manufactured Home

-

HUMAN RESOURCES:

- If you have employees, are you using them efficiently? Have you really evaluated their performance? Could they do the same work in less time per week, or could they be doing more work to assist you?

- Have you learned anything new lately? If you aren’t good with Excel (and you should be), then get online. There are a ton of free and cheap classes from beginner to expert.

ACCOUNTING:

- How is your bookkeeping? Are you keeping track of invoices due? I’m always surprised how long it takes some appraisers to cash a check. Occasionally I will contact an appraiser after 2-3 months goes by and the check has not been deposited, and they will say they never got it, so it must have got lost in the mail. Those people are not keeping track of invoices due. Get that money!

Those are the five main aspects of any business. Five standard workdays, five aspects. Coincidence? Maybe not. If you aren’t doing 1-2 appraisals every day, then try to spend the first hour of your day (don’t put it off until later, do it first!) working on one of these. Monday = Sales, Tuesday = Marketing, etc. Do them in whatever order works for you.

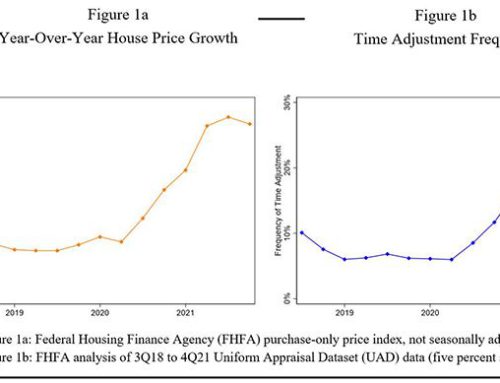

We had a great run from March 2020 – May 2022. That volume was historical and likely won’t be coming back around again in our lifetime. But we should expect to get back to more “normal” volumes when mortgage rates were reasonable and home prices were achievable. I don’t know if you follow us on LinkedIn (https://www.linkedin.com/company/appraisal-house-usa), but there is a post from 11/17/23 that talks a bit about affordability vs. current prices and mortgage rates. Until those two things balance out, things are going to continue to be tight for the mortgage industry. But rates are starting to drop so I have my fingers crossed that this spring is halfway decent. In the meantime, stay positive, get some exercise, and work on your business.

Enjoy your holidays!