The Big Announcement That Wasn’t

Well, I don’t know about other appraisers, but I am both sad and relieved now that the “big announcement that will change the world” has passed.

“Sad” because on some level I had hoped that they had cracked the code and figured out a way to really perform a quality appraisal faster and more reliably.

“Relieved” because now that we know the “big news”, nothing is going to change, and this was a nothing-burger.

Hype vs. Reality

Sure, they will use FUD (FUD is a sales technique; fear, uncertainty, and doubt) to convince some lenders to use a model that has been discussed by the GSE’s since around 2018 and officially rolled out in 2022 (to abject failure). But this isn’t “modernization”. This is backwards, which the GSE’s figured out when they tested this model years ago.

There is nothing here, no great tech, no great innovation, just a well-oiled sales organization trying to convince their target audience that they have unlocked some great secret. Much like miracle diet pills, magnet therapy, or colloidal silver, this is just a refresh of a previously failed attempt to modernize an industry that is very difficult to modernize.

What Appraisers Really Do Best

The whole, “let appraisers do what they do best” trope is and always has been incorrect. What I do best is inspect properties and understand what is important in my market. What I DON’T do as well as a computer – and the teams of mathematics PhD’s that write the algorithms – is data analysis, and it would be crazy to think that my analysis is going to be better than the models the GSE’s already have created. So the hybrid model was always flawed (or more correctly, backwards), and the GSE’s realized that which is why you rarely see it.

The Surgeon Analogy

My other favorite trope is, “does your surgeon take your paperwork when you walk into his office, or does he let the admin do that?” That is not the same. No, the surgeon doesn’t, but he’s also not going to do any work until we’ve had a long conversation. In that scenario the doctor’s admin taking your paperwork is equivalent to the AMC or lender sending the order to the appraiser. The appraiser is the doctor, and it is his job to figure out what the situation is (research the property), and then deal with it (complete the appraisal).

If your surgeon is relying on their admin to listen to your symptoms and then he determines what he is going to do based on the admin’s opinion, find another surgeon…

What the GSEs Should Do

If the GSE’s had any sense, they would pay a qualified appraiser to go do the measurement and inspection, collect the data, and then do the risk analysis themselves through UAD. The plus for lenders is that I could do several inspections per day and submit the data the same day (just like a PDC) so the work would be done quickly. The plus for appraisers is there is no liability in this model, assuming you have accurately reported what you saw on site. No angry realtors or buyers, no lenders asking you to “get another $10k” so they can close, no ROV’s, no underwriter requests.

The Flawed Model in Practice

Unfortunately, these folks have chosen to pursue this failed model, but with the “new and improved” add-on that they will pay for an earlier than usual inspection by a realtor or Uber driver with 30 minutes of YouTube training, then hoping that the deal goes through and they can get paid. An interesting way to spend venture capital, but no one has given me $18M to play with so what do I know?

Why Not Use an Appraiser?

Why not use an appraiser for this? (The same question we were asking back in 2022!) Because they can pay these data collectors $50-$60 vs. paying someone who actually has years of experience and knows what to look for 3x that. (Of course, the fact that the borrower gets charged probably $200-$250 isn’t our concern, that is their profit to do with as they see fit.)

The 5-Step Reality of the Hybrid Process

Lenders, here is how this process works in reality.

Step 1: You order a hybrid, they charge you maybe $200 for the data collection they are paying $60 to get.

Step 2: A generally underqualified person goes and inspects the property, allegedly within 24 hours. (We will see how that works out). That person probably doesn’t know how to measure a house accurately, so they will be using a mobile app like Cubicasa to take the measurement.

Fun Fact #1: Did you know that those apps are not particularly accurate? I do those for realtors because the floorplans are pretty and they get used for marketing, but I always do my own sketch so they can be sure of the SF, and they are NOT accurate. I’ve had houses off by several hundred feet, so get ready for customer complaints!

Fun Fact #2: Those apps like to say they are “aligned with ANSI Z-765” which is the standard that appraisers must measure to, but “aligned” is not “compliant”. If you think that these apps understand that the converted porch is or isn’t part of the GLA according to ANSI, you would be incorrect.

Step 3: This data is uploaded to the GSE’s website and (fingers crossed!) they accept it and you don’t need anything else. The vendor charges you around $200, pockets about 70% of the fee, and everyone is happy (except the appraiser, understandably, who didn’t get the work.)

But what happens if it is rejected by the GSE’s, or their value figure is below what you wanted?

Step 4: Now the vendor has to scramble to find an appraiser willing to take the data gathered by the pizza delivery guy and write a report within 24 hours. They say they already have an army of appraisers nationwide just waiting to do this, knocking out 3 appraisers a day at what this company has described as being <$200 per report. I doubt that, and that any competent appraiser would work for that. but maybe they do..

Step 5: The vendor is going to charge you probably $300 more (at least!), so you have now paid $500 (or more if it is me) for this appraisal. You could have just called me first and I would have knocked it out for about the same price, with more reliability.

The Reality of Appraiser Workload

Here is/are the problem(s).

- I can turn a report in 24 hours, no problem. But only if I’m sitting in my office with nothing else to do, no phone calls, no emails, no ROV’s to deal with, etc. I don’t recall the last time that actually happened, but again maybe these guys have recruited an army of appraisers willing to only work for them, and just sitting by the computer ready to jump on these hybrids when they come in. We will see.

- They like to say, “Would you rather do one report a day at $500 or three reports at $175 and stay at home?” Well, having someone else inspect the property saves me about an hour, maybe 90 minutes depending on drive time. So for me, not having to drive to the house would save you about $100 on my fee, so if they are offering under $200, I am going to be too expensive for them. There are a lot of people like me who aren’t going to work that cheap, so you lose competent appraisers.

Additionally, I don’t see very many easy appraisals that I can turn in 3 hours. In my market, most homes are complicated and require some time and thought. I often need additional documents from lenders, or info from realtors, clarification from owners, etc. That doesn’t fit the “work 9 hours straight at your desk to get 3 reports out per day” model. - I LIKE SEEING THE PROPERTY. I don’t want to sit in front of a computer for 9 hours a day. Yes, I can do a hybrid – and I have no problem doing them because they are correct that the language is different in them than a standard URAR and you are slightly more protected — but the lender gets a better, more reliable product if I am the one to measure it and walk it, and see the neighborhood.

Do you think the kid that got fired from Burger King last week but watched the training video and is now a property inspector is going to comment on the next-door neighbor with 3 junked cars, 5 loud dogs at the fence line, and 20 old appliances littering the back yard? Doubt it.

Yes, there is some percentage of these where the data collection alone is accepted and you don’t even need an appraisal, so I get that.

And I almost certainly wouldn’t have turned it in 24 hours (maybe if you were a really good client), but despite the FUD they are pushing, that just isn’t a thing. It’s “6-minute Abs!”

A 24-hour appraisal is a solution in search of a problem. I can’t tell you how many appraisals I hear back on a week or two weeks later, because they have negotiated additional repairs or similar and want me to modify the report. I talk to a lot of lenders, and no one has said they would greatly benefit from getting an appraisal in 24 hours.

The only time you need an appraisal in 24 hours is when you forgot to order the appraisal and now have a closing date set for this week.

All this being said, I don’t have any ill will towards this company, they are doing what they are supposed to be doing; trying to gain market share and make money. They never said they are trying to create a better world for appraisers.

I have no idea why their leader wastes time online engaging (kind of obnoxiously IMO) with appraisers, or why appraisers waste time thinking they are going to change him into some altruistic champion of appraisers.

Their job is to convince lenders to sign up with them and then get some type of product that could be considered an appraisal out as fast and cheap as possible, and make as much money as possible, and that’s what they are doing. If they can do that without appraisers – a cost center – in the picture, all the better.

The Misleading Data and False Shortage Narrative

They are trying to convince lenders that:

- There are not enough appraisers (not true, and where have we heard that before??)

Here is their graphic (notice there are no numbers on the Y-axis, so the bottom could be 60,000 and the top could be 61,000…)

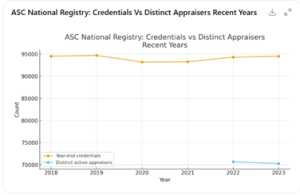

and here is a graph from ASC, a slightly more trusted source:

and here is a graph from ASC, a slightly more trusted source:

Are the numbers declining? A lot of appraisers, like loan officers and realtors, got into the field during Covid, and there is not enough work to support them, so all three fields are experiencing declines. Does that mean appraisal turn times are getting extended, or does that mean we are returning to an equilibrium? No appraiser I know has much trouble turning an appraisal in 4-5 days, and within 48 hours in an emergency. - That loans are falling through because appraisers aren’t fast enough (not true, average turn times in most states are around 5-6 days based on reports from some national AMC’s)

- That we are certain, in the very near future, to experience another Covid era rush of mortgage applications where turn times will be weeks (or months! Or years!). They quote how they saw a rise last year of 30-50% in volume when rates dipped. I don’t remember being swamped last year nor does any appraiser I know, so I’m pretty comfortable that this is just marketing hype. The odds of another market like 2020-2021 are pretty slim, especially in the near future, by any metric.

- That these hybrids are just as good as a regular appraisal. Well, that isn’t true. They have stated that they are “compliant”, which IMO means, “they are good enough to get your loan through”, but they are a step down in terms of reliability. And my fear is that the appraisers who take these are the ones who are just going to hire overseas virtual assistants to type the reports and slap their name on them. The fees will drop, and the quality will drop. The default rate will go up, the buybacks will increase, and this experiment will be over.

That is their job, and they may very well be successful at convincing lenders to buy this product. But this constant effort to “Mcdonald’s-ize” appraisals won’t be good long term and does not help the real estate market, the borrowers, or the lenders.

The Business Reality

I totally understand that many people in this process don’t care how “good” the appraisal is as long as it is adequate and meets the lending guidelines. They just want a number for their file, and their loan to close. And I can live with that, even though I endeavor to make sure every one of my reports is as well-researched, well-written, and as bulletproof as possible. I understand it is probably overkill, but I take pride in my work and I want the borrower to know they got a good appraisal.

But I understand that no one on the mortgage lending side is going to pay me much more because of my experience, knowledge, and effort. I’ve used the example before that when my HVAC quits, I don’t hire the absolute best, most acknowledged genius HVAC repairman in the state to come fix it, I hire whoever seems competent and is reasonably priced. But I also never take the low bid, or the guy with no reviews that answers the phone with “hello” and not his company name. I want some assurance that the person is qualified and will do a good job.

The Final Word

Unless you have just got to have the report tomorrow or the next day in order to close, take the time to let a competent real estate appraiser “do what they do best”, which is the entire process.